Corporation tax calculator

Including marginal reliefWhat is Marginal Rate Relief?

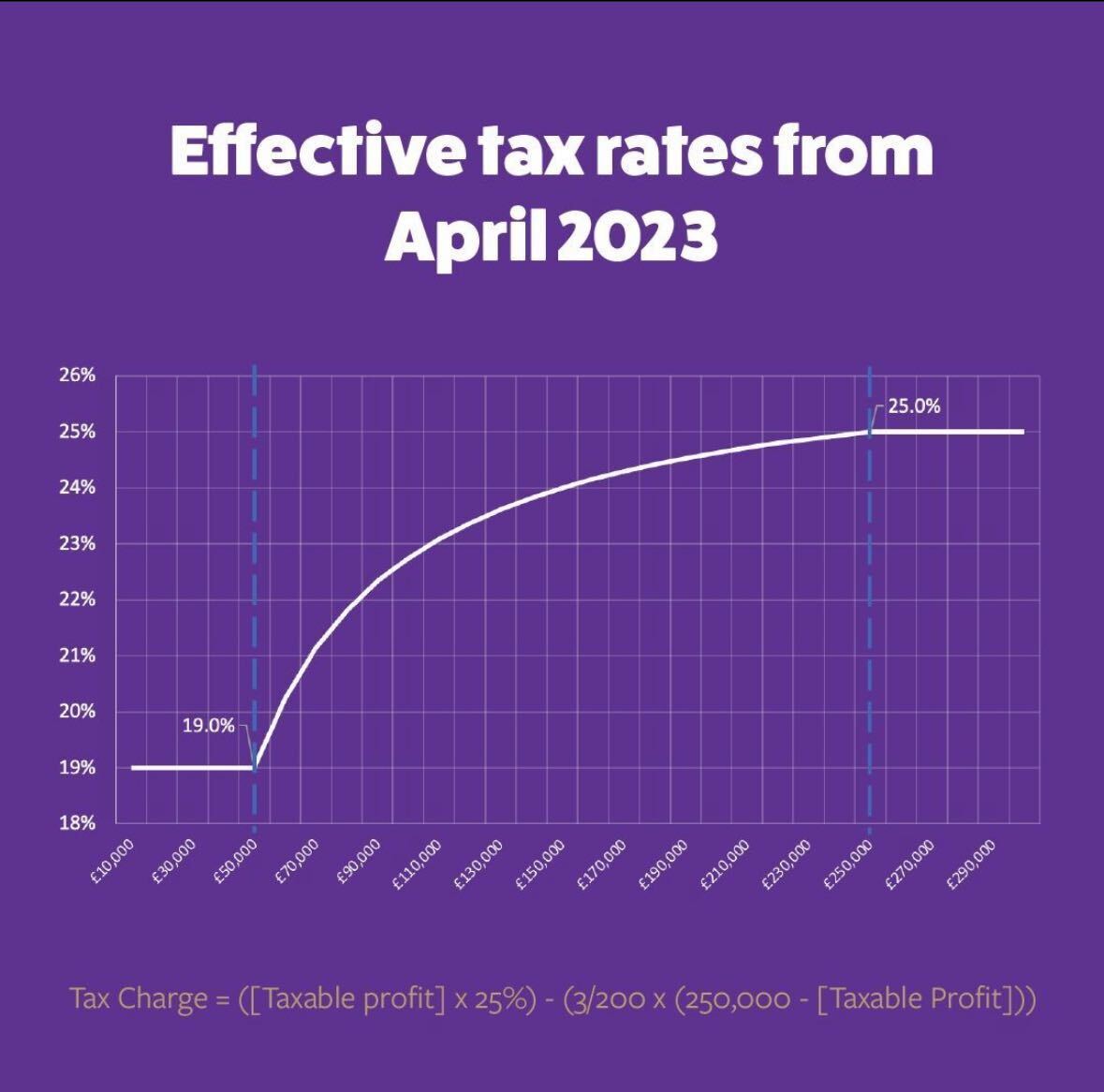

From 1 April 2023 the Corporation Tax rate changes to:

19% for taxable profits below £50,000 (small profit rate)

25% for taxable profits above £250,000 (main rate)

Marginal Relief provides a gradual increase in Corporation Tax rate between the small profits rate and the main rate — this allows you to reduce your rate from the 25% main rate.

Who can claim Marginal Rate Relief?

Your company or organisation may be able to claim Marginal Relief if its taxable profits from 1 April 2023 are between:

£50,000 (the lower limit)

£250,000 (the upper limit)

Disclaimer

Any use of this calculator is at the risk of the user. The calculator does not accommodate associated companies or distributions received.

Looking for ways to minimise your corporation tax exposure?

We’d be happy to help. Book a meeting with us here and we’ll get a conversation started.